Furthermore, you might have to pay a prepayment charge for settling your loan ahead of schedule. Prepayment penalties are usually set at 2% to 4% of your original loan quantity, according to Realtor. com (how much do real estate agents make per sale). While your property owners insurance typically covers the structural elements dvc timeshare of your house in the event of damages brought on by fire or particular types of natural catastrophes, a home service warranty has a different scope.

com, home service warranties can cover repair and/or replacement costs for cooking area appliances and the washer and dryer, in addition to the electrical, plumbing, and heating and air systems. You can offer to acquire a warranty to cover the home leading up to closing, so the purchaser knows they're not dealing with repair expenses as quickly as they sign.

A buyer service warranty can cost in between $300 and $600, according to Real estate agent. com. It's a great perk to offer buyers, but it's not a requirement. By now, you might think you have actually completed paying for all the costs of selling your home. However as you are preparing to transfer to your brand-new house, remember to how to get out of a hilton grand vacation timeshare take the following expenses into account as well.

Three aspects that affect moving costs are: Whether you're moving a short or long range The number of family items you're moving Whether you're moving yourself or hiring expert movers Employing professional movers has its advantages. A full-service mover can manage packing your personal belongings, moving them to your new home, and unpacking them.

HomeAdvisor quotes the expense of expertly moving a three-bedroom home in your area Click for source at $760 to $1,000. Movers charge more for longer range relocations and to transport heavy or bulky products, such as a piano or your kids' swing set. For a DIY relocation, renting a moving truck can cost as little as $50 or over $2,000, according to HomeAdvisor, depending on the size of the truck and the number of miles traveled.

You'll likewise need to pay for boxes, tape, and other packaging materials. If you have things that need to be gotten rid of, you may likewise have to pay for either a portable dumpster that can be gotten, or to have somebody haul those products away. Lastly, you may require to pay deposits for electric, gas, water and trash collection at your brand-new house.

When You Have An Exclusive Contract With A Real Estate Agent, You Can Can Be Fun For Anyone

HomeAdvisor recommends the expense of a move may be two times as high during the summer season. From Might to September, demand for moving trucks and professional moving services peaks, as families typically relocate summer while school is out, and college trainees relocate to and from campus. Greater competition for moving services typically results in higher prices.

If you've currently closed on a new location, you might pay ownership expenses for 2 homes at the same time. That can include both home loans, energy expenses, HOA charges, home taxes and property owners insurance coverage. If you have not closed on the brand-new home or you're still searching for the right one, you'll need to budget for short-lived living arrangements.

According to SpareFoot, the average regular monthly cost of self-service storage varieties from around $66 to almost $135, based upon the size of the system. Bear in mind, in this circumstance you might require to move twice, which aside from being time-consuming, can likewise be extremely pricey. Our analysis of internal and market data recommends that together, transition expenses generally include up to about 1% of the sale cost, presuming a shift period of one and a half months (how to become a real estate agent in pa).

There are generally more costs to selling a house beyond genuine estate representative commissions10% of the list price is an excellent location to start. Take time to compute each of the expenses listed here separately, assuming they use to your circumstance. The more precisely you're able to estimate the total quantity you'll pay, the less space there is for surprises.

In the table listed below, we break down typical home offering expenses, presuming a deal rate of $248,000 the median single-family home rate in the U.S. in the fourth quarter of 2018, according to NAR. You can see that when you take all the expenses into account, the total expense of offering reaches over 16% of the list price.

$ 248,000 Staging expenses $2,480 1% Home repairs & restorations * $12,400 5% Genuine estate representative commissions $14,880 6% Seller concessions $3,720 1. 5% Closing expenses ** $2,480 1% Shift and overlap costs $2,480 1% Moving costs $2,480 1% $40,920 16. 7% $207,080 * For repair expenses, we took the nationwide average in 2018 according to homeadvisor.

The Best Guide To How To Start Real Estate Investing

Editor's Note: This post was originally released in March 2013 and has been upgraded with the most current info. In theory, it's easy. The property agent lists a house for sale, you like it, you negotiate a price with the agent, the seller accepts, your home closes, and the seller pays 6 percent to the broker as their cost.

There are 2 kinds of representatives: buyers' agents and sellers' representatives. In the Hamptons area, buyers' agents are virtually nonexistent compared to other parts of the country, probably because property attorneys sub rather for the buyer's representative during the agreement stage of the deal. If you see a house you like and call the agent and ask to see it, you're handling a sellers' representative.

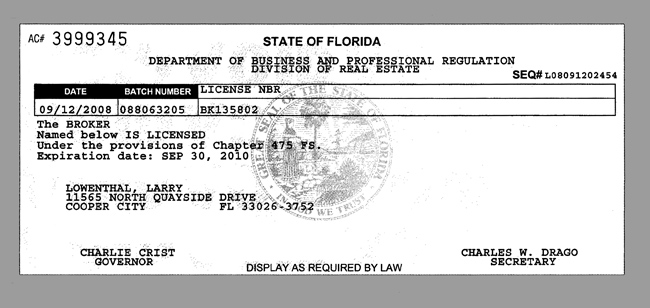

But what's the difference between representatives and brokers? Both genuine estate agents and brokers must be certified. Brokers should pass a harder test than agents, however aren't necessarily more knowledgeable. Representatives work for brokers; they are licensed to offer genuine estate however they can't work separately. Some brokers work straight with house purchasers and sellers, and some have a staff of agents working for them.

Generally, the cost a seller pays a broker is 6 percent, however that can differ. That cost is for a full-service brokerage. Cut-rate brokerages are also progressing understood, however are less popular in the high-cost Hamptons. However, costs may be negotiable, most likely more so in smaller sized brokerages. Agents are more likely to accept a 5 percent commission if the seller is a repeat client or buying along with selling.

Agents normally are paid a portion of the commission received by the brokerage from the sale, sometimes as low as 30-40 percent. Leading representatives receive more. In addition, top agents get what's referred to as a "split" or, a portion of the commissions they generate. This is usually an element that adds to the broker's ability to attract leading talent in the industry.

Usually, buyers do not pay any commission on their side - what is escheat in real estate. The transfer taxes will be of biggest issue to buyers and making sure to tape charges and anything related to financing throughout the process. Do your research study and bear in mind that you are the one on the hook for paying numerous thousandsif not millionsof dollars for this residential or commercial property.